ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

SECOND QUARTER 2019

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Ahhh. A day at the beach. You’re making sandcastles. Riding a boogie board. Enjoying a cold beverage. Not a care in the world. What could go wrong?

Hopefully nothing, but you’ll sure be glad that lifeguard is there if something does. After all, lifeguards are responsible for the safety of people around water and a defined area adjacent to it (like a sandy beach next to the ocean).

Merriam-Webster defines the word guard like this: One assigned to protect or oversee another.

The word guard brings to mind the obvious: security officers, the deodorant (think right, not left), shin guards (soccer, anyone?), the National Guard, and the Coast Guard.

And then there’s guardianship, when one person has legal authority to care for the personal and property interests of another person. Not something that immediately comes to mind and not something most people even want to think about. Guardianships usually can be found in three situations: an incapacitated senior, a minor, and a developmentally disabled adult.

Like that lifeguard on the beach that’s there to preserve your physical wellbeing, a guardian for your minor children can preserve their financial wellbeing if something happens to you.

We had a client whose survivors learned this the hard way. In 2008, we helped a man find the life insurance he wanted to secure his wife’s and children’s futures with a $700,000 policy. He named his wife the beneficiary. After a divorce several years later, the beneficiary designation was changed to the three kids. He made this change directly with the insurance company; we were unaware of the decision to change. In 2015, he passed away suddenly.

The two older children received their death benefit payouts right away. But the youngest was a minor and, by law, the insurance company was unable to release his payout until he was 18. Who would care for him? How would they pay for that care? The braces, sports equipment, music lessons, and childcare.

Eventually, the older sister was named guardian for her younger brother and the insurance company was able to release his portion of the death benefit (plus interest earned). Delays. Court costs. Guidance for the older sister who, numerically was an adult, but emotionally had no idea how to navigate through this process.

This is a classic case of a pool without a lifeguard. The LLIS team can't protect what we don’t know.

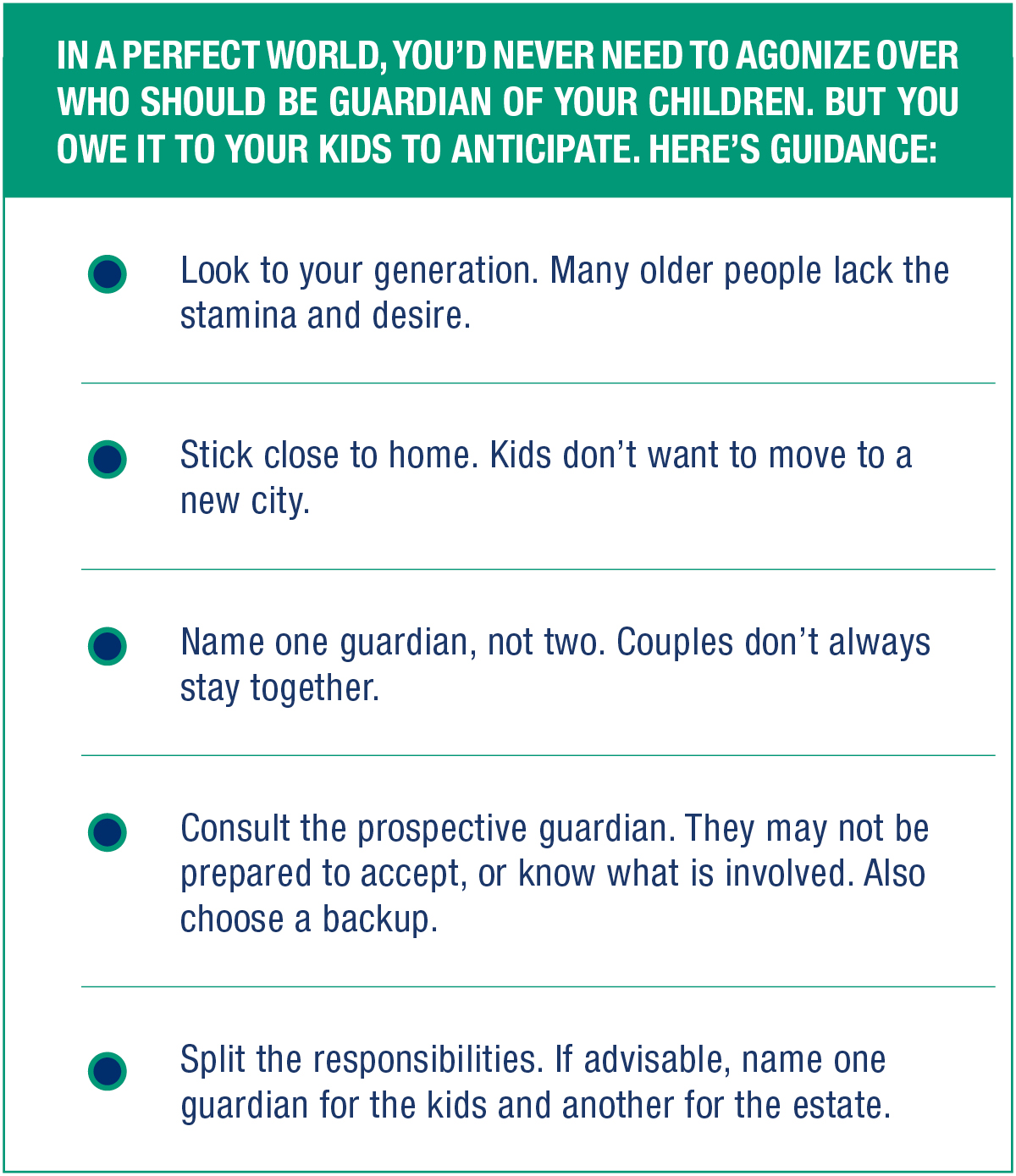

Here is a nice blurb from Kiplinger’s Personal Finance we think you may find helpful:

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".